Stable Forex Brokers are difficult to find these days, so we will try to make things easier.

“Lionheart EWA stands for and with the Traders.”

In the lines to come, we are going to give you valid reasons on why we are collaborating with ECN/STP Brokers, why we chose to tick the ‘’trust box’’ with them, and why we recommend and trust their services, as Forex & CFDs Brokers.

Before we do that, let’s go behind the scenes, use our ‘’back-stage pass’’ and understand the mechanics of the systems. It would be helpful and wise for you to go through all the details below, because the info is very important and it will make a difference in your future trading.

As a Trader or investor, you will need to understand exactly how the System works, so that you will be trading in a safer environment, without any conflict of interest or Broker’s interference.

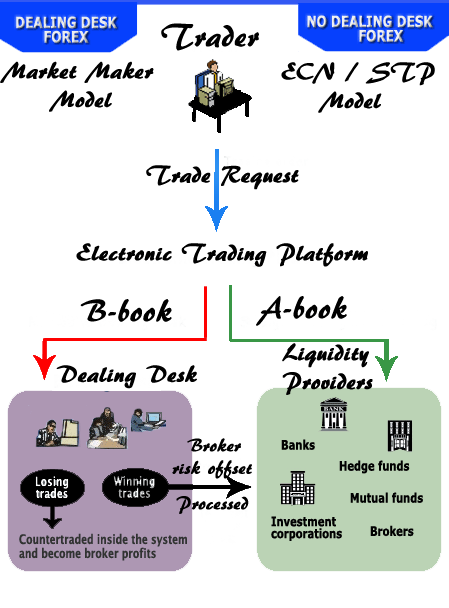

First thing that you need to know is that the Forex Brokers are split in 2 sides, A-book & B-book.

What is the difference between A-book & B-book?The difference is quite important. In fact, it has a huge impact on you as a Trader.

ECN stands for Electronic Communications Network and its Trading Platform is connected electronically and directly with the International Banks or Liquidity Providers. When you trade Forex through such a platform, indeed you are communicating with, and connected to, the Real & True International Currency Market. This is known as Pure A-booking but it is usually available for very Big Market Players as the minimum lot size or minimum deposit size is unaffordable to most Traders.

STP stands for Straight Through Processing and it implies that the orders are directly transferred towards the Top Tier Liquidity Providers, without any Broker Intervention. The process is done automatically through direct electronic communication with the Real & True International Currency Market and also implies the fastest execution.

A true ECN/STP Broker and an A-book, is the one that has its trading platform connected to several Top Tier Liquidity Providers such as Deutsche Bank, Bank of America, HSBC, Barclays, RBS, J.P. Morgan, Morgan Stanley, Citi Bank, Nomura, etc. The Broker routes ALL the opened orders towards the Liquidity Provider and their profits would reflect the spread, swaps or commissions that they charge the Trader. When a trade is opened, the order is distributed among several Liquidity Providers and the system automatically chooses the Liquidity Provider that is offering the best price and the lowest spread.

This is known as A-booking and it’s what most Traders are looking for.

In Forex Trading, the Broker can choose to trade against you. This means that instead of processing the trades requests towards the Liquidity Providers, they can keep your trades ‘’in house’’ and bet against you, taking the other side of the trade.

In other words, they can choose to run your trades through their ‘’Dealing Desk’’ and trade the other way, transforming the Trader’s losses into Broker’s profits. They do this because it’s very profitable for them, as statistics state that 90% of Traders lose their investments in their first trading months. When the Trader makes a profit, it goes out directly from the B-book Broker’s pockets, which results in a Major Conflict of Interest.

This is known as B-booking, and it’s a tricky trading environment.

When opening a trading account, most Traders are looking for ECN/STP Order Execution Model. This is why most of the Forex Brokers who were used to being a Market Maker (B-book) are proudly advertising that they are ECN/STP Brokers just because of some minor changes in their systems, when in fact they are not. Instead, they might as well route your orders towards another Market Maker and their Dealing Desk sharing Trader’s losses between each other.

Here’s how both sides look like:

Some Brokers may choose to be greedy and get the best of both worlds. With advanced software, a B-book Broker can identify the most profitable Traders and process all their orders towards the Liquidity Providers, as if they were A-book, but in the same time continuing to B-book the losing Traders. The signs that they are looking for are when a Trader is trading without a Stop Loss, when the Risk Size of a single trade represents more than 10%, when Leverage is maxed out, when Profits are higher than the Losses or when there’s a continuous winning streak.

Some Brokers may choose to be greedy and get the best of both worlds. With advanced software, a B-book Broker can identify the most profitable Traders and process all their orders towards the Liquidity Providers, as if they were A-book, but in the same time continuing to B-book the losing Traders. The signs that they are looking for are when a Trader is trading without a Stop Loss, when the Risk Size of a single trade represents more than 10%, when Leverage is maxed out, when Profits are higher than the Losses or when there’s a continuous winning streak.

The Liquidity Providers do not like this ‘’toxic flow’’, therefore, some of the trades could indeed be rejected (also known as ‘’last look’’) and the orders will be filled and the next best price, giving the Trader a delayed execution and unwanted slippage.

This is known as Hybrid Model, and it’s an acceptable trading environment, but not great.

Liquidity Providers like the balanced flow of A-book Brokers, therefore, the orders are filled and not rejected.

Lionheart EWA is proudly recommending True STP/ECN and A-book Brokers.

We did not encounter any conflict of interest or anomalies in their systems.

Trading goes smooth and never faced withdrawal delays.

[btnsx id=”28614″]

Forex & CFDs trading is high risk