Greetings valued Investor and thank you for your interest in our Managed Accounts Program!

Lionheart EWA is able to provide Managed Accounts for its Investors.

Years of knowledge and trading experience are combined.

Lionheart EWA is committed to trade on behalf of its Investors, matching their best interest, to generate profit.

Professional funds management

Above-average monthly returns

High-probability trading

The Fund Manager’s intention is to provide the Investor with long-term stability and consistency.

Active trades reflect a Low Risk – High Reward model.

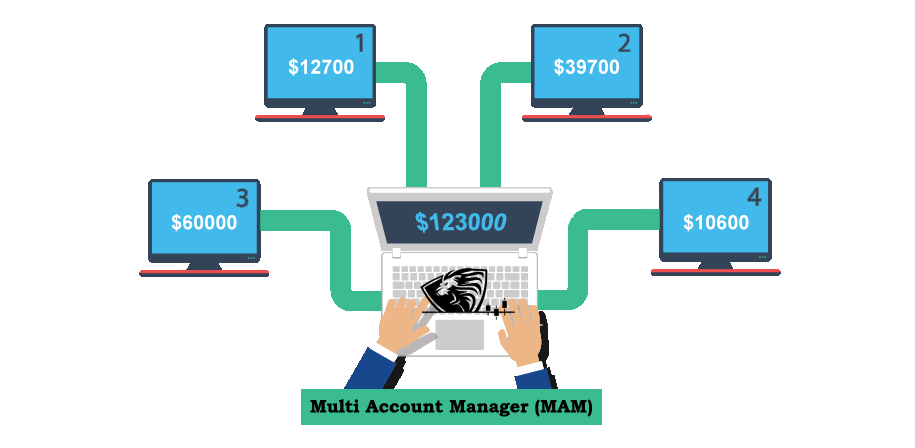

Should an Investor desire to participate in our Managed Accounts Program, it can be possible via our Multi Account Manager (MAM).

The MAM Account is a MetaTrader 4 integrated software tool which allows LEWA to manage and trade on multiple accounts from a single MT4 Interface.

LEWA is acting as the Funds Manager and trading on the Master Account, thus trading in the same manner for multiple sub-accounts.

Multiple sub-accounts

Predefined risk management

Automated allocations

In order for the Investor to be eligible for such a Managed Account, a Limited Power of Attorney (LPOA) and/or Fee Payment Authorization From (FPAF) documents are needed.

These documents are agreed by both sides (LEWA & Investor), and empower LEWA to trade on behalf of the Investor, acting as the Attorney.

Lionheart EWA is able to accept Investors from all continents, as we can provide Managed Accounts solutions alongside several brokerages.

Europe

Africa

Asia

Australia

United States of America

*subject to special application

The Trading Account is under the Investor’s name, giving the Investor absolute control over funds access, deposits & withdrawals, at any time.

Lionheart EWA is incapable of withdrawing or transferring funds on behalf of its Investor.

Funds allocated for the Managed Accounts Program are strictly used for trading purpose.

24/7 Live Reporting over the trading activity and account status is provided via the Investor Portal.

Investor’s funds are kept with a Fully Regulated Broker, ensuring funds Security and Investor’s protection.

Conservative Plan

Max Trading Risk (draw-down): 10 – 15%

Monthly Target & Average Profit: 15 – 25%

Moderate Plan

Max Trading Risk (draw-down): 15 – 30%

Monthly Target & Average Profit: 25 – 50%

The same Trading Strategy is implemented into both plans, the only difference is the risk management and percentage allocations.

Allocations are calculated based on the sub-account configuration.

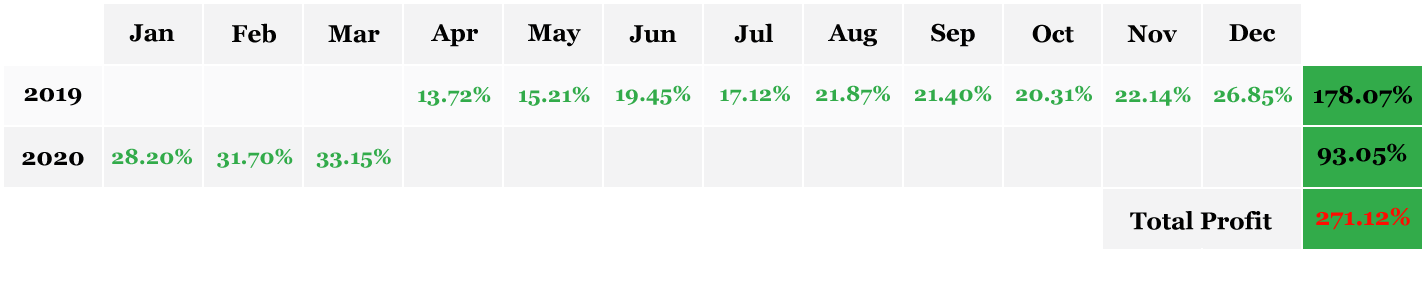

Lionheart EWA is able to provide stability and consistency.

The following 1-year performance reflects a Conservative Sub-Account.

* Past performance does not guarantee future results.

Forex & CFDs trading carries a high level of risk.

Full risk disclosure in our T&C.

LEWA does not charge its Investors with Subscription or Management Fees.

Instead, LEWA and Investor partnership is based on Profit Performance.

Minimum Investment: $5000

Performance Fee (Profit Share): 30%

Trading Commission: up to $10 / lot

Subscription & Management Fee: 0

Profit Distribution: Monthly

1st Step | MAM Request

In order to apply for the Managed Accounts Program or to receive more details, please fill out the Contact Form below and express your intentions.

Error: Contact form not found.

2nd Step | Evaluation

Book yourself a ‘Managed Account” Appointment with the button below. You will be contacted at the scheduled time.

After a discussion with the Funds Manager and a brief evaluation, the Investor would be declared as Eligible & Approved for the next stages.

[setmoreplus button]

3rd Step | Sub-Account Application

Documents required:

Proof of Identity – Valid government issued ID or Passport.

Proof of Address – Bank Statement or Utility Bill, with the name and address of the account holder and not older than 3 months.

[rpt name=”mam-details-managed-accounts”]

4th Step | Account Funding

After your account has been validated, you may login the Client Portal with the provided credentials.

At this stage, your sub-account is linked to the master-account, and we shall be able to commence our partnership.

You may now deposit the desired amount, which you wish to allocate for the investment.

Once the funds reflect in your sub-account, then the partnership has started.

All done! Nothing more to do, except to let the Fund Manager use his trading skills.

Thank you for jumping on board!

“Stay in the green with us, we’ll have many pips ahead !”

– Profit Share: 30% from the Total Performance Fee

– Trading Commission: $3 per traded Lot

– Commissions Distribution: Monthly

* If interested in introducing Investors or to become a MAM Agent, please contact us.

[setmoreplus button]