Indices Trading | Elliott Wave Structures | Q2 2019

Indices Trading | Elliott Wave Structures | Q2 2019

Markets: EU & US Indices

- VIX (Volatility Index)

- CAC40

- DAX30

- FTSE100

- DOW30

- SPX500

- NAS100

Indices worldwide bounce-back with the end of 2018, when the consolidation cycle has ended.

The bullish structure is impulsive but it’s about to end soon, in the sense that it could most likely represent the 1st leg of the returning Bull Market.

When it comes to volatility VIX has been sliding on the down-side, showing a dangerous wedge formation, which could result in a proper spike in volatility occurring very soon.

With the recent sharp declines noticed in global indices, there is no doubt that stock exchanges worldwide are running out of steam, with a realistic possibility of a bigger contraction “lurking”.

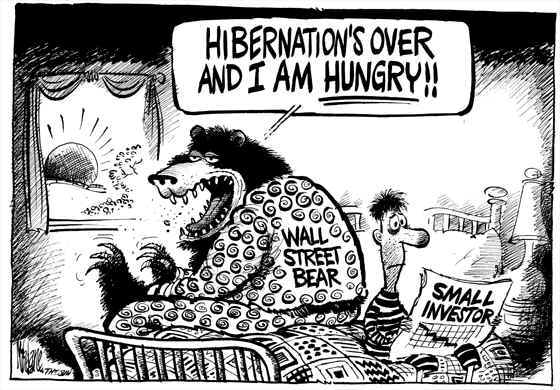

Once again, bears are threatening the markets!

If you are following my analysis for a while, you might know that I’ve been able to time the sell-offs witnessed back in Jan-Oct-Dec last year.

So, let’s move on and ask ourselves the most important question?

“Is this going to be a healthy retracement or are the stock exchanges finalizing the bull market?”

Preferably, and by listening to my charts, I would say that we are in a wave 2 of a larger degree bullish swing, the last one before the Market Crash.

Yes, the Crash is coming!

I’ve been patiently waiting for this bullish impulses to show sights of exhaustion, and now that I see clear signs, it’s time to keep on watching for favorable patterns.

In short, Indices world-wide are approaching crucial levels, which if breached in an impulsive manner, it could result in a violent shock-wave.

Indices need to be able to bounce-back asap, should the bull market be destined to resume.

If unable, then it’s that big ugly bear knocking on the door again.

In order to help my fellow traders, I’ve prepared some Daily Charts for global indexes, which you could use for your trading enhancements.

Should you want to correlate these views on Indices with other markets, then you may find the articles below quite useful.

In the lines to come I will be sharing the way I’m labeling Indices, pointing towards possible scenarios for the second quarter of 2019.

Want to join the Invest Fund?

[btnsx id=”7375″]

Need 1on1 Charting Sessions?

[btnsx id=”7378″]

Indices | Elliott Wave Analysis

Ready for those Daily Chart on Indices?

Great stuff!

Before we take a look at the Daily Charts on Indices, let’s first see the VIX current location.

VIX – Elliott Wave Outlook

Pattern:

Leading Diagonal in Intermediate (1) (blue)

“Bullish” Divergence soon to launch a spikeNext expected swing:

Violent rise and a spike in volatility in Intermediate (2) (blue)Structure change:

An impulsive continuation for the down-side could lead towards Indices rallying in a 3 of 3’s.

CAC40 – Elliott Wave Outlook

Bearish Swings – Patterns:

Triple Three structure in Cycle Wave IV (green)

W (purple) – Zig-Zag

X (purple) – Three (false break-out)

Y (purple) – Simple Flat

X (purple) – Contracting Triangle

Z (purple) – Zig-ZagBullish Swings – Patterns:

Impulse in Intermediate (1) (blue)

Extension in Minor 3 (green)Next expected swing:

Bearish sequence in Intermediate (2) (blue)Structure change:

Bullish continuation in an impulsive manner could lead towards more up-side for an Ending Diagonal.

DAX30 – Elliott Wave Outlook

Bearish Swings – Patterns:

Triple Three structure in Super-Cycle Wave (IV) (green)

W (purple) – Expanding Flat

X (purple) – Three (false break-out)

Y (purple) – Complex Flat with a Descending Triangle

X (purple) – Running Flat

Z (purple) – Zig-ZagBullish Swings – Patterns:

Impulse in Intermediate (1) (blue)

Leading DiagonalNext expected swing:

Bearish sequence in Intermediate (2) (blue)Structure change:

Bullish continuation in an impulsive manner could lead towards more up-side for in a big extension.

DAX30 – Daily Interactive Chart

FTSE100 – Elliott Wave Outlook

FTSE100 – Daily Chart (picture)

Bearish Swings – Patterns:

Flat Structure in Cycle Wave IV (green)

Primary A (turquoise) – Simple ABC Swing

Primary B (turquoise) – Complex Flat

Primary C (turquoise) – Bearish ExtensionBullish Swings – Patterns:

Leading Diagonal in Intermediate (A) (blue)Next expected swing:

Bearish sequence in Intermediate (B) (blue)Structure change:

Breach of the lower trend-line could lead towards Intermediate (B) (blue) already in play.

FTSE100 – Daily Interactive Chart

US30 – Elliott Wave Outlook

US30 – Daily Chart (picture)

Bearish Swings – Patterns:

Flat Formation in Super-Cycle Wave (IV) (green)

Primary A (red) – Simple ABC Swing

Primary B (red) – Running Flat

Primary C (red) – Bearish ExtensionBullish Swings – Patterns:

Leading Diagonal in Primary 1 (pink)

ABC Swings in Intermediate degrees (1)(2)(3)(4)(5) (blue)Next expected swing:

Bearish sequence in Primary (2) (pink)Structure change:

Breach of the lower trend-line could lead towards Primary (2) (pink) already unfolding.

US30 – Daily Interactive Chart

SPX500 – Elliott Wave Outlook

SPX500 – Daily Chart (picture)

Bearish Swings – Patterns:

Flat Formation in Cycle Wave (IV) (green)

Primary A (red) – Simple ABC Swing

Primary B (red) – Complex Triple Three

Primary C (red) – Bearish ExtensionBullish Swings – Patterns:

Leading Diagonal in Primary 1 (pink)

Intermediate (1) (blue) – Impulse

Intermediate (2) (blue) – Complex Flat

Intermediate (3) (blue) – Bullish Extension

Intermediate (4) (blue) – Sharp Correction

Intermediate (5) (blue) – Ending DiagonalNext expected swing:

Bearish sequence in Primary (2) (pink)Structure change:

Breach of the lower trend-line could lead towards Primary (2) (pink) already unfolding.

SPX500 – Daily Interactive Chart

NAS100 – Elliott Wave Outlook

NAS100 – Daily Chart (picture)

Bearish Swings – Patterns:

Complex Flat in Cycle Wave (IV) (green)

Primary W (purple) – Zig-Zag

Primary X (purple) – Complex Triple Three

Primary Y (purple) – Simple ABC SwingBullish Swings – Patterns:

Bullish Impulse in Primary 1 (pink)

Intermediate (1) (green) – Impulse

Intermediate (2) (green) – Complex Correction

Intermediate (3) (green) – Bullish Extension

Intermediate (4) (green) – Sharp Correction

Intermediate (5) (green) – Extended Ending DiagonalNext expected swing:

Bearish sequence in Primary (2) (pink)Structure change:

Breach of the lower trend-line could lead towards Primary (2) (pink) already unfolding.

NAS100 – Daily Interactive Chart

[btnsx id=”7375″]

Need 1on1 Charting Sessions?

[btnsx id=”7378″]