"This is a Market Crash road-map. Like it or share it please! It could help others too..."

Market Crash Cycles | Indices | Macro Trends | Elliott Wave Structures

Market Crash Cycle | Indices | Macro Trends | Elliott Wave Structures

Markets: Indices – Europe / USA / Asia

- VIX (Volatility Index)

- CAC40 (France)

- DAX30 (Germany)

- FTSE100 (UK)

- DOW30 (USA)

- SPX500 (USA)

- NAS100 (USA)

- NI225 (Japan)

- HSI (HK)

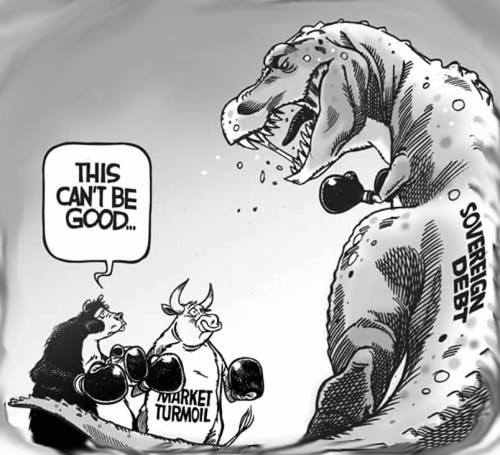

Market Crash! Such a “terrific” word!

I chose this word to describe this emotional state of the markets for a reason. For most it can translate as a terrifying experience, while for some it can transcend into a major opportunity.

Timing this event is crucial indeed. In the lines to come, I will try my best to express my thoughts on the presented charts in the cleanest possible manner.

It is without a doubt that we are in a Bull Market, but what can be noticed is that large degrees corrections have occurred. This means that the Market needs to make a “shining” decision.

From a technical stand-point, these corrections should not cause an imminent threat and stock markets should continue the bullish cycles for one last time in the pursuit of the next “bubble”.

However, if they become a threat and volatility truly spikes in an excessive manner, then the Market Crash has already begun.

Speaking of volatility… allow me to get things straight!

You might not be following me for that long, but back in February 2018 I was able to successfully forecast the end of the bullish cycle.

Exactly on Feb 2nd 2018 when the complacency sentiment was peaking, I posted an article explaining that a “sudden” burst of bearishness would surround global indices.

In this article I was explaining the VIX indicator but also sharing some Macro Charts which have been unfolding favorable directions ever since.

After the “fear” effect faded, the markets have returned with diagonals and reversal patterns, indicating that the bears were not done.

During the second half of 2018, charts have been showing Market Crash Patterns which indicated that Indices could have been preparing for even bigger drops.

Close to the end of September things were getting serious and about to conclude, so I posted the trigger points.

October suddenly became “Red October”.

While the bearish sentiment was invading the minds of unprepared and complacent traders, I continued my bearish stance in November.

In December, corrections were finalizing and then I realized that Indices worldwide would be falling off the edge of the cliff for one last time.

Do I have your attention? Let’s proceed!

In the lines to come I will expand my views on the Market Crash Cycles, current positions of global Indices, but also pointing towards scenarios and how to best interpret them.

Want to join the Invest Fund?

[btnsx id=”7494″]

Need 1on1 Charting Sessions?

[btnsx id=”7498″]

Market Crash Cycles – VIX

VIX should be able to resume the down-trend soon and complete the “greed” cycle, which in turn would translate bullish momentum for Indices and a postpone of the inevitable Market Crash sequence.

If however a break-out would occur, then a proper spike could be in play, translating into a prolonged “fear” period.

Nevertheless, these are crucial times and the movements will be epic. Just need to be on top of it and keep on tracking, confirm and then tap into the real trend.

Eat, sleep, trade and visualize those pips piling up.

VIX – Weekly Interactive Chart

(click to open)

Macro Trends – Indices – European Market Crash

CAC40 – France Macro Perspective – Elliott Wave

Structure – Flat Formation

2000 peaks and down until 2003 bottoms – Grand Super-Cycle wave A (black)

2003 bottoms up until 2007 tops – Super-Cycle wave (a) (purple)

2007 tops and down until 2009 lows – Super-Cycle wave (b) (purple)

2009 lows and up until present times – Super-Cycle wave (C) (purple)Super-Cycle (C) (purple)

Pattern – Ending Diagonal

Sequence – 5 Wave Sequence, with Cycle Waves I II III IV V (green) decomposed as Primary ABC (turquoise)Current Position

Cycle Wave V (green)Next expected swing

Bearish sequence in Primary B (turquoise)Market Crash Forecast

Support granted at or around the 5300.00 mark and then a bull run towards the 6250.00 levels, where the Grand Super-Cycle Wave B (black) is expected to complete.

Grand Super-Cycle Wave C (black) would reflect the next Larger Degree Recession.Structure change

Breach of the lower trend-line of the Ending Diagonal could reflect the fact that the Market Crash already started.

CAC40 – Monthly Interactive Chart

(click to open)

DAX30 – Germany Macro Perspective – Elliott Wave

Structure – Ending Diagonal

2009 lows and up until Apr 2015 peak – Grand Super-Cycle I (green)

Apr 2015 peak and down until Feb 2016 lows – Grand Super-Cycle II (green)

Feb 2016 lows and up until Nov 2017 extremes – Grand Super-Cycle III (green)

Nov 2017 extremes and down until Dec 2018 – Grand Super-Cycle IV (green)Grand Super-Cycle V (green)

Pattern – Ending Diagonal Overshoot

Sequence – ABC Sequence within Super-Cycle Waves (A)(B)(C) (purple)Current Position

Super-Cycle Wave (A) (purple)Next expected swing

Bearish sequence in Super-Cycle Wave (B) (purple)Market Crash Forecast

Support granted at or around the 11500.00 mark and then a huge rally towards the 15000.00 levels, where Sub-Millennium 5 (blue) is expected to complete.

Sub-Millennium Waves ABC (red) would reflect the next Larger Degree Recession.Structure change

Breach of the lower trend-line of the Ending Diagonal could reflect the fact that the Market Crash already started.

DAX30 – Monthly Interactive Chart

(click to open)

FTSE100 – United Kingdom Macro Perspective – Elliott Wave

FTSE100 has been labeled within a Grand Super-Cycle degree wave IV (blue), which has been unfolding ever since the Dot-Com bubble.

Structure – Expanding Flat Formation

2000 peaks and down until 2003 bottoms – Super-Cycle wave (a) (red)

2003 bottoms up until 2007 tops – Cycle wave a (black)

2007 tops and down until 2009 lows – Cycle wave b (black)

2009 lows and up until present times – Cycle wave C (black)Cycle C (black)

Pattern – Ending Diagonal

Sequence – 5-Wave Sequence, with Primary Waves 1 2 3 4 5 (green) decomposed as Intermediate (A)(B)(C) (blue)Current Position

Primary Wave 5 (green)Next expected swing

Bearish sequence in Intermediate (B) (blue)Market Crash Forecast

Support granted at or around the 7000.00 mark and then a bull run towards the 9000.00 levels, where the Super-Cycle Wave (b) (red) is expected to complete.

Super-Cycle Wave (c) (red) would reflect the next Larger Degree Recession.Structure change

Breach of the lower trend-line of the Ascending Channel could reflect the fact that the Market Crash already started.

FTSE100 – Monthly Interactive Chart

(click to open)

Macro Trends – Indices – USA Market Crash

US30 – USA (Industrial) Macro Perspective – Elliott Wave

US30 – Monthly Chart (picture)

US30 has been labeled within a Grand Super-Cycle degree wave V (blue), which has been unfolding ever since the 2009 bottom, when the Recession ended.

Structure – Bullish Impulse

2009 lows and up until Apr 2010 highs – Super-Cycle (I) (green)

Apr 2010 highs and down July 2010 lows – Super-Cycle (II) (green)

July 2010 lows and all the way up until Oct 2018 extreme – Super-Cycle (III) (green)

Oct 2018 extreme and sharp drops until Dec 2018 – Super-Cycle (IV) (green)Super-Cycle (V) (green)

Pattern – Reversal Motive Wave

Sequence – 5-Wave Sequence within an Ending DiagonalCurrent Position

Cycle Wave I (black)Next expected swing

Bearish sequence in Cycle Wave II (black)Market Crash Forecast

Support granted at or around the 25000.00 mark and then a huge rally towards the 28500.00 levels, where Grand Super-Cycle V (blue) is expected to complete.

Super-Cycle Waves (A)(B)(C) (red) would reflect the next Larger Degree Recession.Structure change

Breach of the 25000.00 levels could lead towards a prolonged corrective structure and a Market Crash already starting.

US30 – Monthly Interactive Chart

(click to open)

SPX500 – USA (Market-Cap) Macro Perspective – Elliott Wave

SPX500 – Monthly Chart (picture)

SPX500 has been labeled within a Grand Super-Cycle degree wave V (blue), which has been unfolding ever since the 2009 bottom, when the Recession ended.

Structure – Bullish Impulse

2009 lows and up until Apr 2010 highs – Super-Cycle (I) (green)

Apr 2010 highs and down July 2010 lows – Super-Cycle (II) (green)

July 2010 lows and all the way up until Oct 2018 extreme – Super-Cycle (III) (green)

Oct 2018 extreme and sharp drops until Dec 2018 – Super-Cycle (IV) (green)Super-Cycle (V) (green)

Pattern – Reversal Motive Wave

Sequence – 5-Wave Sequence within an Ending DiagonalCurrent Position

Cycle Wave I (black)Next expected swing

Bearish sequence in Cycle Wave II (black)Market Crash Forecast

Support granted at or around the 2700.00 mark and then a huge rally towards the 3500.00 levels, where Grand Super-Cycle V (blue) is expected to complete.

Super-Cycle Waves (A)(B)(C) (red) would reflect the next Larger Degree Recession.Structure change

Breach of the 2700.00 levels could lead towards a prolonged corrective structure and a Market Crash already starting.

SPX500 – Monthly Interactive Chart

(click to open)

NAS100 – USA (Tech) Macro Perspective – Elliott Wave

NAS100 – Monthly Chart (picture)

NAS100 has been labeled within a Sub-Millennium degree wave 3 (pink), which has been unfolding ever since the Dot-Com effect and 2003 bottom, when the tech Recession tapped out.

Structure – Bullish Impulse

2003 lows and up until Nov 2007 highs – Grand Super-Cycle I (blue)

Nov 2007 highs and down until Nov 2008 Recession lows – Grand Super-Cycle II (blue)

Nov 2008 Recession lows and all the way up until Oct 2018 extreme – Grand Super-Cycle III (blue)

Oct 2018 extreme and sharp drops until Dec 2018 – Grand Super-Cycle IV (blue)Grand Super-Cycle V (blue)

Pattern – Reversal Motive Wave

Sequence – 5-Wave Sequence within an Ending DiagonalCurrent Position

Super-Cycle Wave (I) (turquoise)Next expected swing

Bearish sequence Super-Cycle Wave (II) (turquoise)Market Crash Forecast

Support granted at or around the 7000.00 mark and then a huge rally towards the 9000.00 levels, where Sub-Millennium Wave 3 (pink) is expected to complete.

Grand Super-Cycle Waves A-B-C (red) would reflect the next Larger Degree Recession.Structure change

Breach of the 7000.00 levels could lead towards a prolonged corrective structure and a Market Crash already starting.

NAS100 – Monthly Interactive Chart

(click to open)

Macro Trends – Indices – Asian Market Crash

NI225 – Japan Macro Perspective – Elliott Wave

NI225 – Monthly Chart (picture)

NI225 has been labeled within a Grand Super-Cycle degree wave B (pink), which has been unfolding ever since the Tokyo Stock Bubble back in 1990.

Structure – Flat Formation

1990 bubble peak and down until Apr 2003 bottoms – Super-Cycle (w) (purple)

2003 bottoms up until 2007 tops – Cycle wave a (turquoise)

2007 tops and down until 2008 lows – Cycle wave b (turquoise)

2008 lows and up until present times – Cycle wave C (turquoise), the final leg of Super-Cycle (X) (purple)Cycle wave C (turquoise)

Pattern – Ending Diagonal

Sequence – 5-Wave Sequence, with Primary Waves 1 2 3 4 5 (green) decomposed as Intermediate (A)(B)(C) (blue)Current Position

Primary Wave 5 (green)Next expected swing

Bearish sequence in Intermediate (B) (blue)Market Crash Forecast

Support granted at or around the 21000.00 mark and then a bull run towards the 27000.00 levels, where Super-Cycle (X) (purple) is expected to complete

Cycle Waves a-b-c (red) would reflect the next Larger Degree Recession or even a DepressionStructure change:

Breach of the lower trend-line of the Ending Diagonal could reflect the fact that the Market Crash already started.

NI225 – Monthly Interactive Chart

(click to open)

HSI – Hong Kong Macro Perspective – Elliott Wave

HSI has been labeled within a Sub-Millennium degree wave 4 (blue), which has been unfolding ever since the 2007-2008 Recession.

Structure – Expanding Flat Formation

Oct 2007 peaks and down until Oct 2008 bottoms – Grand Super-Cycle wave a (red)

Oct 2008 bottoms and up until Nov 2010 tops – Super-Cycle wave (a) (purple)

Nov 2010 tops and down until Feb 2016 lows – Super-Cycle wave (b) (purple)

Feb 2016 lows and up until present times – Super-Cycle wave (c) (black)Super-Cycle wave (c) (black)

Pattern – Ending Diagonal

Sequence – 5-Wave Sequence, with Cycle Waves I II III IV V (black) decomposed as Primary A-B-C (blue)Current Position

Cycle Wave III (black)Next expected swing

Bearish sequence in Primary B (blue)Market Crash Forecast

Support granted at or around the 28000.00 mark and then a bull run towards the 33000.00 levels, where the Grand Super-Cycle Wave b (red) is expected to complete.

Grand Super-Cycle Wave c (red) would reflect the next Larger Degree Recession.Structure change

Breach of the lower trend-line of the Ending Diagonal could reflect the fact that the Market Crash already started.

HSI – Monthly Interactive Chart

(click to open)

I am keen on trading the Market Crash. Are you?

Trade with me!

Want to join the Invest Fund?

[btnsx id=”7494″]

Need 1on1 Charting Sessions?

[btnsx id=”7498″]

Thank you for reading this article until the end! I hope you see the patterns clearer now. As always,